Why Lagos Is Your Next Property Investment Destination: The Ultimate Guide for 2025

As the sun rises over the Lagos Lagoon, casting golden reflections across the city’s evolving skyline, savvy investors worldwide focus on this vibrant West African metropolis. Lagos—Nigeria’s economic powerhouse and Africa’s largest city—has emerged as one of the continent’s most compelling real estate investment destinations.

But what exactly makes Lagos property worthy of your investment portfolio in 2025? Are the remarkable appreciation rates consistently outperforming many global markets? Is the rapidly expanding middle class driving residential demand? Or perhaps the strategic positioning as Africa’s technology and financial services hub?

In this comprehensive analysis, we’ll explore the data-driven case for Lagos real estate investment, examine the city’s most promising neighborhoods, and provide you with actionable insights to capitalize on this dynamic market before mainstream international attention drives prices beyond current attractive entry points.

The Numbers Don’t Lie: Lagos Real Estate by the Data

Before making any investment decision, prudent investors demand compelling data. Let’s examine the numbers that have increasingly attracted both local and international capital to the Lagos property market:

Appreciation Metrics That Demand Attention

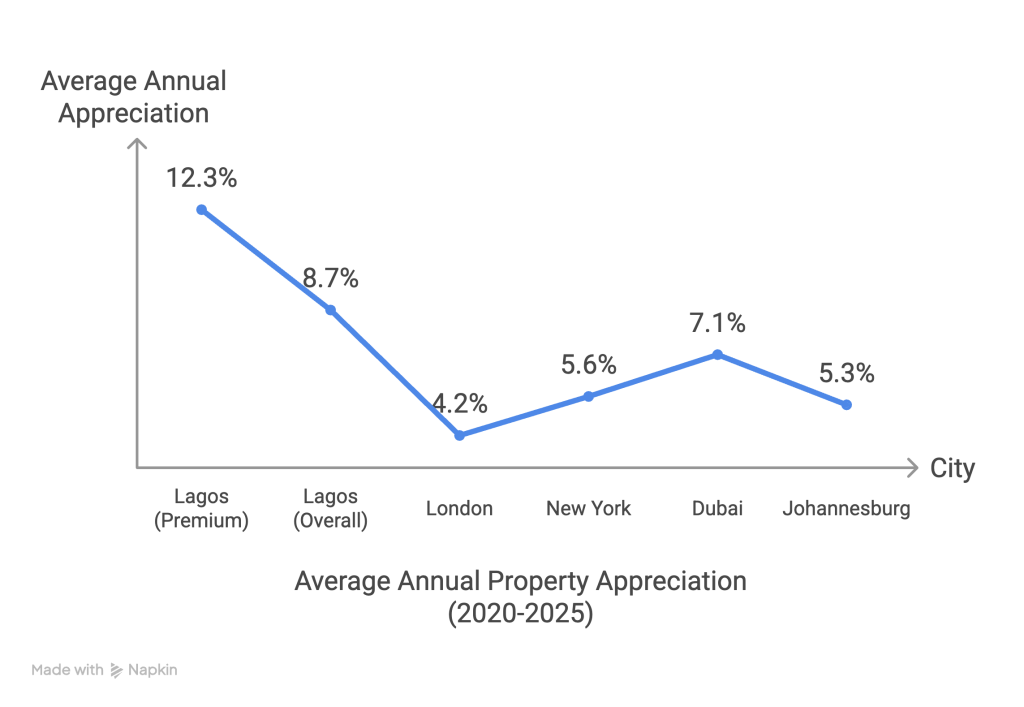

According to the Nigerian Institution of Estate Surveyors and Valuers (NIESV), prime Lagos residential properties have appreciated at an average annual rate of 8.7% over the past five years (2020-2025), with premium neighborhoods like Ikoyi and Banana Island seeing even more impressive figures approaching 12.3% annually.

For context, this outperforms many established global real estate markets:

This severe housing shortfall creates a powerful tailwind for property investors, particularly in middle-income residential segments where demand significantly outstrips supply.

Rental Yields That Reward Investors

For income-focused investors, Lagos offers compelling rental returns that frequently surpass those available in more mature markets:

Investment Insight: The combination of strong appreciation potential and attractive rental yields creates a compelling total return profile rarely found in single investment markets.

Lagos Neighborhood Analysis: Where to Invest in 2025

Not all Lagos neighborhoods offer equal investment potential. Our proprietary analysis identifies the most promising areas for different investment strategies and budget levels:

Established Premium Markets: Ikoyi, Victoria Island, Banana Island

These prestigious locations continue to attract Nigeria’s elite and expatriate communities:

- Price Range: ₦250M-₦1.5B ($100,000-$1,000,000+)

- Best For: Wealth preservation, stable appreciation, premium rental income

- Risk Level: Low-Medium

- Notable Development: The new Ikoyi-Lekki bridge expansion has reduced commute times by 35%, further enhancing Ikoyi’s appeal for high-income professionals

Investor Profile: These areas attract established investors seeking stability and prestige, including diaspora Nigerians and institutional investors looking for flagship properties.

Emerging High-Growth Areas: Lekki Phase 1 & 2, Ajah

The Lekki Peninsula continues its remarkable transformation, offering a compelling blend of lifestyle amenities and investment potential:

- Price Range: ₦75M-₦350M ($50,000-$230,000)

- Best For: Capital appreciation, balanced returns

- Risk Level: Medium

- Notable Development: The Lekki Free Trade Zone and Deep Sea Port project has accelerated development along this corridor, with property values in surrounding areas increasing 25-40% within 18 months of project announcements

Investor Profile: These neighborhoods attract forward-thinking investors seeking more substantial appreciation potential while maintaining reasonable rental yields, including young professionals and middle-stage investors building diverse portfolios.

Upcoming Value Markets: Ogudu GRA, Yaba, Surulere, Gbagada

These mainland areas offer excellent value propositions with strong fundamentals:

- Price Range: ₦40M-₦150M ($27,000-$100,000)

- Best For: Cash flow, yield optimization, entry-level investment

- Risk Level: Medium-High

- Notable Development: Yaba’s emergence as Lagos’s technology hub (dubbed “Yabacon Valley”) has attracted young professionals and created rental demand, driving rental yields to 9.5% on average

Investor Profile: These areas attract yield-focused investors and first-time property buyers seeking accessible entry points with solid cash flow potential.

Five Key Drivers Positioning Lagos for Real Estate Growth

Understanding the structural factors supporting Lagos’s real estate market provides crucial context for investment decisions:

1. Nigeria’s Macroeconomic Trajectory

Nigeria remains Africa’s largest economy with a GDP of approximately $574 billion (2025). Despite historical volatility, several factors support long-term economic expansion:

- Economic Diversification: Progressive movement beyond oil dependence

- Growing Services Sector: Now contributes over 52% to GDP

- Digital Economy Growth: Expanding at 15.2% annually, creating high-income jobs

- Financial Services Expansion: Lagos solidifying position as West Africa’s financial hub

2. Infrastructure Development Transforming Accessibility

Strategic infrastructure investments are unlocking previously undervalued areas:

- The Lagos Blue Line rail system completion has reduced commute times by up to 65% from the mainland to the island business districts

- The Lagos-Calabar Coastal Highway project is enhancing connectivity to emerging areas

- Expanded Lagos International Airport capacity has increased international visitor traffic by 28%

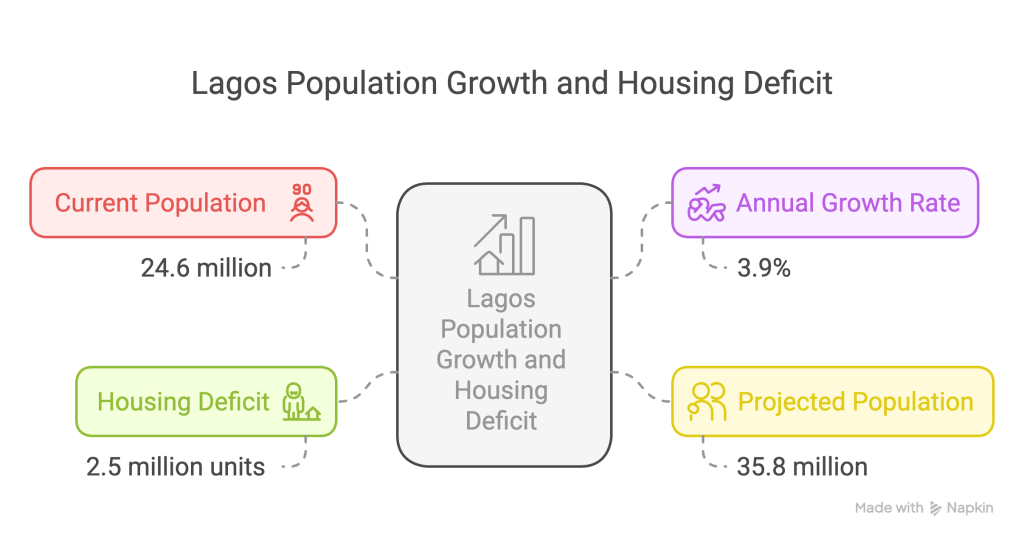

3. Nigeria’s Expanding Middle Class

The Nigerian middle class continues to grow, with particular concentration in Lagos:

- Middle-class households in Lagos: 1.8 million (2025)

- Projected growth: 3.2 million by 2030

- Average income: ₦12.5M-₦30M annually ($8,300-$20,000)

- Homeownership aspiration rate: 83% among middle-class professionals

4. International Investment Inflows

Lagos is increasingly appearing on international investors’ radar:

- Foreign direct investment in Lagos real estate: $1.2 billion (2024)

- Year-over-year growth: 23%

- Primary source countries: UK, US, China, South Africa, and UAE

- Institutional investment focus: Commercial developments, master-planned communities

5. Technology and Innovation Hub Status

Lagos’s emergence as Africa’s leading technology ecosystem creates unique real estate opportunities:

- Active startups in Lagos: 1,200+

- Tech ecosystem valuation: $9 billion

- Annual office space absorption by tech companies: 25,000 sqm

- Tech worker housing preference: Premium 1-2 bedroom apartments within 5km of major tech hubs

Investment Strategies for Different Investor Profiles

Based on your investment goals and capital availability, consider these tailored Lagos real estate strategies:

For First-Time International Investors (₦50M-₦150M / $33,000-$100,000)

Recommended Strategy: Mid-tier residential units in mainland growth areas

- Target Areas: Yaba, Surulere, Gbagada

- Property Type: 2-3 bedroom apartments in secure developments

- Expected Returns: 8-9% rental yield, 7-10% annual appreciation

- Risk Mitigation: Focus on completed properties with established rental history

- Exit Strategy: Hold 5-7 years for optimal appreciation

For Mid-Level Portfolio Diversification (₦150M-₦350M / $100,000-$230,000)

Recommended Strategy: Premium residential in emerging high-growth zones

- Target Areas: Lekki Phase 1 & 2, Oniru, Ikate

- Property Type: 3-4 bedroom townhouses or luxury apartments

- Expected Returns: 7-8% rental yield, 10-12% annual appreciation

- Risk Mitigation: Prioritize developments by established builders with quality track records

- Exit Strategy: Hold 4-6 years with option to refinance for additional investment

For High Net Worth Investors (₦350M+ / $230,000+)

Recommended Strategy: Mixed-use developments in established premium areas

- Target Areas: Ikoyi, Victoria Island, Banana Island

- Property Type: Luxury residential units or small commercial properties

- Expected Returns: 6-7% rental yield, 11-13% annual appreciation

- Risk Mitigation: Professional property management is essential for optimal returns

- Exit Strategy: Long-term hold (8- 10+ years) with potential generational wealth transfer

Navigating the Unique Challenges of Lagos Real Estate

Informed investors acknowledge and prepare for market-specific challenges:

Legal and Regulatory Considerations

The Nigerian property market presents unique legal considerations requiring careful navigation:

- Title Verification: Only 20% of Lagos properties have perfect title documentation; thorough verification is essential

- Multiple Taxation: Various government levels impose property taxes; comprehensive tax planning is advisable

- Foreign Ownership Rules: Non-Nigerian citizens can own property, but face certain restrictions on agricultural land

Solution: Partner with reputable local legal advisors specializing in real estate with experience assisting international investors.

Infrastructure Gaps

While improving, infrastructure challenges persist in specific areas:

- Power Supply: Many developments require backup power solutions

- Water Access: Private water systems are often necessary in specific neighborhoods

- Road Quality: Varies significantly by area, affecting accessibility and value

Solution: Prioritize developments with robust private infrastructure solutions (power backup, water treatment, etc.) and assess neighborhood infrastructure quality firsthand.

Currency Considerations

For international investors, currency fluctuation presents both risks and opportunities:

- Naira Volatility: Historical depreciation patterns require strategic planning

- Rental Income: Can be structured in Naira or USD, depending on property type and tenant profile

- Exit Strategies: Currency hedging should be considered for repatriation planning

Solution: Consider properties with USD-denominated rental potential (corporate leases, expatriate-focused residential) and explore structured exit strategies that mitigate currency risk.

Real-Life Success Story: From Skeptic to Satisfied Investor

Meet Mr. Lawal Adegbite, a Lagos-born technology executive who has built his career in London for over 25 years. Despite his Nigerian roots, he remained skeptical about investing in Lagos real estate, concerned about market stability and management challenges.

In 2022, Adegbite decided to test the market with a modest investment: a ₦85M two-bedroom apartment in emerging Yaba, attracted by the area’s growing technology ecosystem.

“What surprised me most wasn’t just the financial return,” Adegbite explains. “It was how professional the property management services had become. My property is managed entirely remotely, with digital reporting and minimal input needed from me despite living thousands of miles away.”

Adegbite has since expanded his Lagos portfolio to include two additional properties, including a commercial unit leased to a multinational corporation.

Your Next Steps: Building Your Lagos Property Investment Roadmap

Ready to explore Lagos real estate investment opportunities? Here’s your actionable roadmap:

Step 1: Define Your Investment Parameters

- Determine your budget range and investment timeline

- Clarify your primary objective (appreciation, cash flow, or balanced returns)

- Establish your risk tolerance honestly

Step 2: Conduct Targeted Market Research

- Schedule a personalized Lagos market briefing with our investment advisors

- Request our neighborhood-specific analysis reports

- Review recent transaction data from your target areas

Step 3: Plan Your Market Visit (or Virtual Alternative)

- Arrange property viewings in your shortlisted neighborhoods

- Meet potential property managers and legal advisors

- Experience neighborhood amenities firsthand

Step 4: Structure Your Investment Vehicle

- Determine optimal ownership structure (personal, corporate, partnership)

- Establish your financing approach (cash purchase, developer financing, mortgage)

- Create your tax optimization strategy

Step 5: Build Your Local Support Team

- Engage experienced legal representation

- Select a reputable property management company

- Connect with reliable maintenance providers

Conclusion: Lagos Real Estate in a Global Context

As traditional investment markets struggle with compressed yields and limited growth potential, Lagos presents a compelling alternative for investors seeking robust returns. Combining strong demographic fundamentals, infrastructure development, and economic diversification creates multiple value drivers supporting long-term real estate appreciation.

While not without challenges, these same complexities create market inefficiencies that informed investors can leverage to achieve returns that have become increasingly rare in more mature markets. The window of opportunity—before broader international investment drives prices upward—makes 2025 a particularly strategic time to establish a Lagos property position.

Whether you’re a Nigerian professional in the diaspora looking to reconnect with your roots through strategic investment, or an international investor seeking portfolio diversification with strong growth potential, Lagos real estate deserves serious consideration as your next investment destination.

Take Action Today

📊 Download Our Complete Lagos Property Market Report

Get neighborhood-by-neighborhood analysis, price trends, and growth projections for 2025-2030. Download Now

🏙️ Schedule Your Personalized Investment Consultation

Our team of Lagos property experts will create a customized investment strategy aligned with your specific goals. Book Consultation

🏢 Browse Our Curated Investment Property Portfolio

Explore pre-vetted investment opportunities across Lagos’s most promising neighborhoods. View Properties

This article was prepared by [Brick & Click Realty], a leading Lagos real estate advisory firm specializing in investment strategy for local and international investors. The information provided is based on market data as of May 2025 and represents our professional assessment of current market conditions. Individual investment results may vary, and readers must conduct due diligence and seek professional advice before making investment decisions.