Commercial vs. Residential Property Investment in Nigeria: 2025 Returns Analysis

Commercial vs. Residential Property Investment in Nigeria: 2025 Returns Analysis

Nigeria’s real estate sector continues to represent one of the most resilient investment vehicles in the country’s diverse economic landscape. As we navigate through 2025, investors increasingly scrutinise the comparative advantages of commercial and residential property investments. This growing interest stems from Nigeria’s persistent urbanisation trend, with the urban population projected to reach 60% by 2030, creating substantial demand across property segments. Additionally, the stabilising economic indicators following recent policy reforms have positioned real estate as a hedging instrument against inflation, which currently stands at 12.3%. This analysis examines commercial and residential property sectors, offering evidence-based insights into which segment may yield superior returns for investors in Nigeria’s dynamic property market this year.

Understanding Commercial vs. Residential Property Investment

Commercial Property Investment

Commercial property investment refers to acquiring real estate primarily used for business purposes. These properties generate income through leasing to businesses and include:

- Office buildings

- Retail spaces (shopping malls, storefronts)

- Industrial properties (warehouses, factories)

- Hospitality establishments (hotels, event centres)

In Nigeria, commercial properties typically operate on longer lease terms (3-10 years) than residential properties, often with built-in rent escalation clauses that help maintain returns above inflation rates. Commercial leases frequently use the “triple net” structure, where tenants bear responsibility for maintenance costs, insurance, and property taxes, protecting landlords from unpredictable expenses.

Residential Property Investment

Residential property investment involves purchasing real estate where people live, including:

- Apartments and flats

- Single-family homes

- Duplexes and terrace houses

- Luxury villas and estates

The residential sector in Nigeria operates on shorter lease terms (typically 1-2 years) with more frequent tenant turnover. Unlike commercial properties, residential landlords remain responsible for most maintenance and property management expenses.

Current Market Trends in Nigeria

The Nigerian real estate market demonstrates notable trends that warrant investor attention:

- Economic Context: Following the removal of fuel subsidies and currency reforms in late 2023, the economy has stabilised. Real GDP growth is projected at 3.8% for 2025, creating a more predictable investment environment.

- Urbanisation: Major cities like Lagos, Abuja, and Port Harcourt continue experiencing rapid population growth, driving demand for residential and commercial spaces.

- Government Initiatives: The Federal Mortgage Bank of Nigeria (FMBN) has expanded its housing development programs, with N250 billion allocated for affordable housing initiatives in 2025, potentially impacting the residential sector.

- Foreign Direct Investment: The Nigerian Investment Promotion Commission reports a 22% increase in real estate FDI commitments for 2024-2025, primarily directed toward commercial development projects.

- Technology Integration: PropTech adoption is increasing, with digital platforms facilitating property transactions and management, reducing operational friction in both sectors.

Investment Journey: Tales from the Field

Commercial Success Story: Landmark Centre, Lagos

The development of the Landmark Centre in Victoria Island provides an instructive case study in commercial property investment. When developer Paul Onwuanibe acquired the waterfront land in 2011, many questioned the viability of a mixed-use commercial complex in that location.

The initial investment of approximately $100 million faced scepticism, but Onwuanibe’s analysis identified a significant gap in Lagos’ premium office and retail space market. By 2023, the development generated annual returns exceeding 18%, with occupancy rates consistently above 85% despite economic fluctuations.

“The secret was understanding the evolving needs of multinational corporations and premium retailers,” Onwuanibe explained in a recent interview. “We focused on providing world-class facilities with reliable infrastructure, which commanded premium rates even during economic downturns.”

Residential Success Story: Imperial Gardens, Abuja

In contrast, Hakeem Ogunniran’s investment in the Imperial Gardens residential development in Abuja demonstrates the potential of the residential sector. Beginning with 50 mid-range apartments in 2018, Ogunniran’s company strategically targeted the growing middle-class professional demographic.

The initial investment of N3.5 billion has yielded consistent annual returns between 12-15%. Despite higher tenant turnover than commercial properties, Ogunniran implemented efficient management systems that minimised vacancy periods.

“Residential property investment in Nigeria requires understanding demographic trends and lifestyle aspirations,” Ogunniran noted. “Our success came from creating communities, not just buildings, which allowed us to maintain high occupancy rates and steadily increase rental values.”

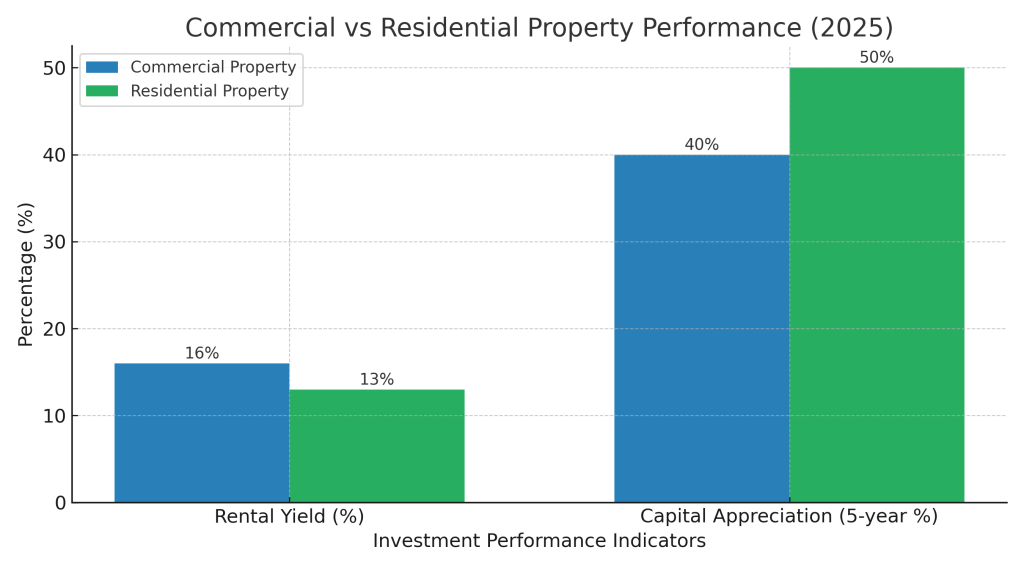

2025 Returns Analysis: Commercial vs. Residential

Commercial Property Projected Returns

Analysis of current market indicators suggests the following return projections for commercial properties in Nigeria in 2025:

Average Annual Returns by Property Type:

- Premium Office Space: 14-16%

- Retail (Shopping Malls): 13-15%

- Industrial/Warehouse: 16-18%

- Hospitality: 12-14%

These projections factor in Nigeria’s current inflation rate of 12.3% and are influenced by:

- Location Sensitivity: Prime locations in Lagos and Abuja can command returns 3-5 percentage points higher than secondary cities.

- Infrastructure Quality: Properties with reliable power, security, and digital infrastructure command premium rents, increasing potential returns by 2-3%.

- Economic Sector Exposure: Properties leased to tenants in resilient sectors such as telecommunications and financial services demonstrate more stable returns.

- Lease Structure: Triple-net leases with built-in escalation clauses significantly enhance long-term yield stability.

The commercial sector’s primary advantage lies in longer lease terms and higher rental yields, particularly in premium locations. However, these properties require substantially higher initial capital investment and may experience more extended vacancy periods during tenant transitions.

Residential Property Projected Returns

For residential properties, 2025 projections indicate:

Average Annual Returns by Property Type:

- Luxury Apartments: 10-12%

- Mid-range Apartments: 12-14%

- Budget Housing: 14-16%

- Serviced Apartments: 15-17%

These returns are influenced by:

- Affordability Factor: Properties aligned with middle-income affordability demonstrate higher occupancy rates and more stable returns.

- Security Considerations: Gated communities and estates with enhanced security features command 20-30% premium in rental values.

- Amenities: Developments offering reliable power, water, and community facilities show 15-20% higher rental values than comparable properties without such amenities.

- Emerging Locations: Strategic investments in developing neighbourhoods with improving infrastructure show potential for capital appreciation exceeding 20% annually.

Residential investments typically require lower initial capital but may involve higher management intensity due to shorter lease terms and more frequent tenant interactions.

Commercial vs. Residential: Comparative Analysis

Factors Influencing Your Investment Decision

Have you considered how your investment horizon aligns with different property types? Commercial properties typically demonstrate superior performance over more extended holding periods (7+ years), while residential properties may offer greater flexibility for investors with shorter timeframes.

What level of management involvement are you prepared to undertake? Residential properties often require frequent landlord intervention, while commercial properties may demand more sophisticated but less frequent management attention.

How would your investment strategy accommodate Nigeria’s economic cycles? Commercial properties reflect economic performance more directly, while residential demand demonstrates greater resilience during economic contractions.

Making Your Decision: Key Considerations

When comparing commercial and residential property investments in Nigeria for 2025, consider:

- Capital Availability: Commercial properties generally require significantly higher initial investment but may offer more stable long-term returns.

- Risk Tolerance: Residential properties typically present lower vacancy risk but may involve more intensive management requirements.

- Geographic Focus: Lagos and Abuja dominate commercial returns, while residential opportunities may be more geographically distributed.

- Economic Outlook: Commercial property performance correlates more strongly with financial performance, while residential demand remains more stable through economic cycles.

- Management Capacity: Commercial properties often require more sophisticated but less frequent management intervention than residential properties.

Conclusion

The analysis reveals that Nigeria’s commercial and residential property investments offer compelling opportunities in 2025, with projected returns significantly outpacing inflation. Commercial properties deliver higher rental yields and lower management intensity but require substantially higher initial capital. Conversely, residential investments offer lower barriers to entry, potentially superior capital appreciation, and higher liquidity, though with more intensive management requirements.

Commercial properties in prime locations present attractive risk-adjusted returns for investors with substantial capital and longer investment horizons. Meanwhile, investors with moderate capital seeking more liquid investments may find greater alignment with residential properties in strategically selected locations.

As Nigeria’s real estate market matures, the most successful investors will be those who carefully match their investment strategy with their financial capacity, risk tolerance, and management capabilities. Before making any investment decision, consider consulting with real estate professionals familiar with specific target markets to develop a strategy aligned with your financial objectives.

What has been your experience with property investment in Nigeria? Have you found greater success with commercial or residential properties? Share your insights in the comments below and help fellow investors navigate this dynamic market.

This analysis was prepared in April 2025 based on current market indicators and projections. Market conditions may change, requiring adjustments to investment strategies.